Second Quarter Performance – Q2 2023

July 2023

A Solid Halftime Report for 2023 Markets

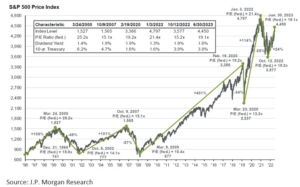

Major stock market indices made significant gains in the second quarter, adding to the gains in the first quarter of the year due to improving inflation, slowing Fed rate hikes, the absence of a recession, a more stable banking sector, and a strong rally in tech stocks.

The S&P 500 has climbed 16.9% with reinvested dividends this year, while the Nasdaq and Dow have returned 32.3% and 4.9%, respectively. Markets have recovered much of their losses from last year with the S&P 500 now 7% from its all-time high. Bond prices pulled back in the second quarter, as expectations have grown that the Federal Reserve will be taking interest rates still higher and holding them there longer but remain positive for the year.

Given this strong year-to-date equity performance, many investors may be wondering whether this is truly the beginning of a new bull market or is instead a “bear market rally.” At the beginning of the year, concerns were elevated that a recession was pending with an expected negative impact on corporate earnings. While earnings growth year over year has stalled for the market in aggregate, the flattish profile of earnings has been greeted with valuation multiple expansion back above the longer-term average.

However, the top ten stocks by market cap size have driven this year’s rally. The leading contributors were tech giants Apple AAPL (up 17.8% for the quarter and 49.6% for the first half of the year), Microsoft MSFT (up 18.4% for the quarter and 42.6% for the first half), Nvidia NVDA (up 52.3% for the quarter and 189.5% for the first half), and Amazon AMZN (up 26.2% for the quarter and 55.2% for the first half). Through May, the top 10 stocks were responsible for 9.3 percentage points, or 97%, of the U.S. market’s overall 9.6 percentage-point gain. In June, the concentration broadened, with stocks like Eli Lilly and Adobe also contributing to the gains.

The concentration of performance in the largest stocks has been reflected in dispersion of returns by style with growth stocks outperforming value and core stocks. Value and defensive oriented sectors such as utilities, consumer defensive, energy, financials, and healthcare have significantly lagged more growth and economically sensitive sectors such as technology, consumer cyclical,

communication services and industrials.

Another attribute of what has been working and not working has been dividend stocks. Dividend strategies lagged the broader market as mega-cap, high-growth companies fared better than value.

The Morningstar Dividend Composite Index—a broad measure of dividend stock performance—gained 3.2% during the second quarter, about 5 full percentage points behind the overall stock market. And since January, it’s up just 3.8%, lagging the broader market by nearly 13 percentage points. Among dividend-paying stocks, companies that have been growing their dividends over time fared slightly better. The Morningstar Dividend Growth Index rose 3.6% during the second quarter and ended the first half of the year up 4.2%.

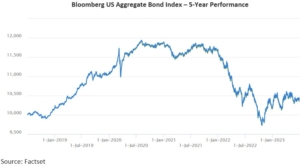

On the fixed income investment front, the historic negative returns of 2022 have given way to stabilization in 2023 with the broad index (AGG) posting a slightly positive return (+0.8%) for the first half of the year.

The bond market pulled back during the second quarter from gains realized in the first quarter of 2023 as the Federal Reserve suggested more Fed funds rate increases are on the table. As yields went up, particularly among short-term maturities, interest-rate-sensitive bonds suffered. Long-term bonds—those due in 10 years or more, whose longer durations make them highly sensitive to interest rates—were hit hardest, but significantly less than experienced during 2022 as rates are seen as close to peaking.

Investment Outlook

The stock market is off to a strong start this year, with better-than-expected earnings resiliency, low relative valuation levels exiting 2022, and excitement about the potential for artificial intelligence (AI). While the market recovery could have more legs, predicting the short-term direction of the market is difficult. However, fundamentals including steady economic growth and improving corporate earnings tend to drive markets higher over the course of quarters, years, and decades.

Looking ahead in the near term, we have concerns that the rate of economic growth may slow sequentially in the third and fourth

quarters, before bottoming out in 2024, driven by tight monetary policy, and reduced credit availability. Given valuation expansion that has already been realized year-to-date, we suspect the rate of market gains may be limited over the next few quarters.

We also see the above average valuation metrics creating a smaller margin of safety in the event of weaker economic or corporate data as a catalyst for risk-off sentiment leading to brief selloffs. However, we suspect any pullbacks should be relatively shallow and not anywhere near the magnitude of the selloff in 2022 as the market looks through to the eventual recovery and weaker economic data may allow an easing of monetary policy.

In terms of positioning, we do see an opportunity in remaining invested with exposure diversified across equity styles. Given the dispersion of performance that has occurred year-to-date, we see a potential pause in the market overall, particularly from recent winners, which might set the stage for improved relative performance from year-to-date laggards such as defensive and dividend grower equities.

The information contained herein is for informational purposes only, is not personalized investment advice and should not be construed as a recommendation to purchase or sell any particular security, sector or strategy to any individual person or entity. The decision to review or consider the purchase or sale of any security, sector or strategy mentioned should not be undertaken

without consideration of your personal financial information, investment objectives and risk tolerance with your financial professional. Past performance should not be considered as an indicator of future results. Investment Advice offered through Pallas Capital Advisors LLC, a registered investment advisor

Sincerely,

Second Quarter Performance – A Solid Halftime Report for 2023 Markets