Rising Long-Term Yields Casts a Shadow on Third Quarter 2023 Financial Performance

November 2023

Rising Long-Term Yields Casts a Shadow on Third Quarter 2023

Financial Performance

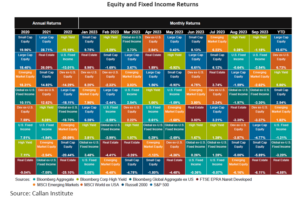

Major financial market indices retreated in the third quarter as the Federal Reserve discussed the possibility of maintaining higher

short-term interest rates for an extended period, along with the rise in long-term bond yields and the resilience of the economy. What was once seen as positive news for the U.S. economy, propelling expectations higher in the first half of the year, turned into a headwind as expectations shifted towards the Federal Reserve potentially continuing to raise rates, postponing the prospect of lower rates far into the future.

Equity markets reached their yearly peak in late July but faced a downturn for the remainder of the quarter, closing near their lowest

point. The broad U.S. equity market declined by over 3.2% for the quarter, with growth stocks falling by 5.9% and value stocks by 1.9%.

For the year, the benchmark S&P 500 remained up by 13.1%, driven by a small group of mega-cap growth stocks, while small-cap equities saw only a 2.5% increase. Globally, developed market equities outside the U.S. also experienced a setback during the quarter and have now risen by 6.7% for the year.

Emerging market equities displayed significant volatility throughout 2023, and this trend persisted into the third quarter. For the year,

emerging market equities posted only a 1.8% gain. Similarly, U.S. aggregate fixed income returns fell by 3.2% for the quarter and 1.2%

for the year. High-yield bonds, however, remained a bright spot in the fixed-income market, delivering a positive return in the third

quarter and a 5.9% return for the year. This positive performance can be attributed to receding concerns about a recession, resulting in

narrower risk spreads.

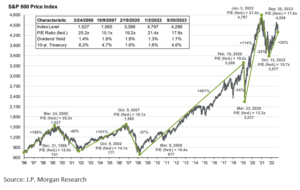

Despite upwardly revised earnings estimates, the pullback in equity prices caused the price/earnings ratio (P/E) for the S&P 500 to decrease to 17.8X at the end of the quarter, compared to 21.4X at the beginning of the year. While this level remains above the 25-year

average P/E, it is primarily driven by the largest constituents of the index. The top 10 names in the S&P 500 index trade at a P/E of

25.9X, whereas the remaining stocks have a P/E of 16.8X.

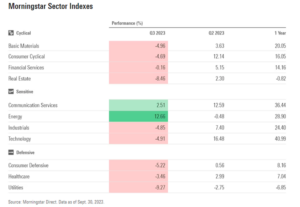

While value stocks outperformed growth stocks in the third quarter, value continues to lag far behind growth on a year-to-date basis.

The valuation divergence between growth and value stocks is particularly noteworthy with value stocks trading at a 20-year historical

discount to growth stocks, only briefly matched during the nadir of the Covid stock-induced sell-off. Defensive sectors such as utilities

and consumer as well as real estate (REITS) saw further absolute and relative underperformance in the third quarter. The underperformance of these sectors has been driven by valuation compression given the sensitivity to rising bond yields.

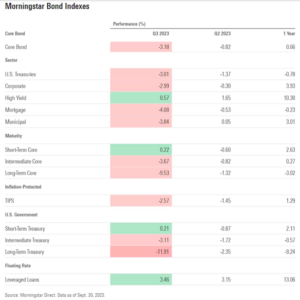

After fixed income returns stabilized in the first half of 2023, following historic negative returns in 2022, they experienced a setback, with the benchmark U.S. aggregate bond index declining by 3.2% and now marking a negative return for the third consecutive year. The strength of the economy has contributed to positive returns in public credit-exposed categories, such as high yield, and has also provided tailwinds for private credit. Short-term bond and Treasury yields have partially offset depreciation for both the quarter and the year, maintaining slightly positive total returns

The bond market pulled back during the second quarter from gains realized in the first quarter of 2023 as the Federal Reserve suggested more Fed funds rate increases are on the table. As yields went up, particularly among short-term maturities, interest-rate-sensitive bonds suffered. Long-term bonds—those due in 10 years or more, whose longer durations make them highly sensitive to interest rates were hit hardest, but significantly less than experienced during 2022 as rates are seen as close to peaking.

Investment Outlook

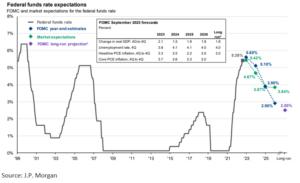

While financial markets reacted positively in the first half of 2023 to better-than-feared economic and earnings resiliency and moderating inflation, good economic news and business resiliency turned into expectations for higher federal funds rates and higher long-term rates over a longer period. With the fear of an imminent recession being dismissed, long-term interest rate policy and levels have become the key drivers for financial asset performance. At the beginning of 2023, rate cuts were highly anticipated as a possibility before the year’s end. However, there are no expectations for rate cuts in 2023, and further rate increases are still seen as a possibility. As higher rates for a more extended period have become the new norm, the belief in rate cuts has been pushed back to late 2024 and 2025. Confidence has also waned in expectations for lower rates, as financial markets adopt a view of structurally higher long-term rates following an extended period of perceived artificially low rates.

Looking ahead, we believe that the rate of economic growth may slow due to tight monetary policy, reduced credit availability, and the eventual exhaustion of consumer spending—the primary driver of the U.S. economy. Mounting geopolitical instability and apparent dysfunction within U.S. governance add additional fuel to potential disruptions in both the U.S. and the global economy. Without the potential catalyst for lower interest rates, we suspect that the rate of market gains may be limited. However, we see the potential for slower economic growth to be favorable for further slowing inflation, which should provide valuation support for both equities and fixed income.

In terms of positioning, we believe there are opportunities in remaining invested with exposure diversified across equity styles. Given the performance dispersion that has occurred year-to-date, we still believe that the stage is set for improved relative performance from year-to-date laggards, such as defensive and dividend growth equities. Growth equities that can support relatively rich valuation levels with faster underlying earnings growth and free cash flow should also remain attractive.

Fixed income also remains historically attractive. The yield curve inversion has flattened, making shorter-duration fixed income and

even money market accounts less advantageous on a current yield basis. While this has weighed on longer-duration values, which move inversely with yields, we continue to believe that inflation will likely decrease over time, providing a catalyst for the eventual easing of the Federal Fund’s rate and a clear potential for appreciation in longer-duration bonds.

Sincerely,

Rising Long-Term Yields Casts a Shadow on Third Quarter 2023 Financial Performance