Fourth Quarter 2023 Financial Performance

January 2024

Financial Markets Finish a Strong 2023 Pulling Forward Some of

the Positive Catalysts for 2024

Financial markets finished the year on a strong note and defied the bearish sentiment entering the year. Sparked by high inflation, rising rates, and geopolitical concerns, the market entered 2023 with expectations for a recession. However, the real story of 2023 was a resilient U.S. consumer, growth in gross domestic product (GDP), and positive revisions to corporate earnings. Meanwhile, Fed policy remained hawkish through the third quarter, with rate hikes and a message of “higher for longer”. This cast a shadow on financial markets through the end of October with equities broadly flat excluding huge rallies by several mega-cap tech names dubbed “the magnificent seven” and fixed-income investments headed to a third year in a row of losses. November and December, though, saw a strong reversal in both the broader equity markets and fixed income as inflation moderated and the Fed indicated rates had likely peaked and forecast rate cuts to occur in 2024. The late-year rally drove the broad US equity market up 12.1% for the fourth quarter and the core bond index up 6.5%.

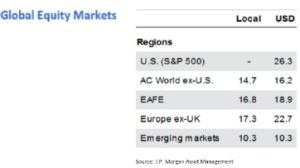

For the year, the S&P 500 was up 24.2%, the NASDAQ up 43.4% (driven by the magnificent seven), and small-cap equities up 15.1%. International equity markets also had a strong year posting a 16.2% return. Buoyed by the end-of-the-year rally, fixed-income returns broke positive for the year ending up 5.3%.

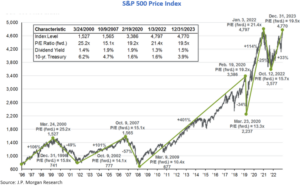

The S&P 500 ended the year at 4,770, just below its record peak of 4,797 reached on January 3, 2022. While the price/earnings ratio (P/E) for the S&P 500 remains elevated at 19.5X, it did finish the year below previous peak levels. However, the current elevated valuation of the S&P500 is driven by the largest market cap-weighted stocks. On an equal-weighted basis, the P/E for the index is a more reasonable 16.5X.

Looking at 2023 equity performance by style and sector shows significant divergence. By style, growth stocks (up 38.5%) significantly outperformed value stocks (up 12.0%) and large cap outperformed small cap. The valuation divergence between growth and value stocks is particularly noteworthy with value stocks trading at a 20-year historical discount to growth stocks, only briefly matched during the nadir of the Covid stock-induced sell-off. Defensive sectors such as utilities, healthcare, and consumer staples were positive but lagged the market in the fourth quarter and were vast underperformers for the year with utilities negative on an absolute basis and the worst-performing sector. After strong absolute and relative performance in 2021 and 2022, the energy sector produced negative returns both in the fourth quarter and for the entire year of 2023.

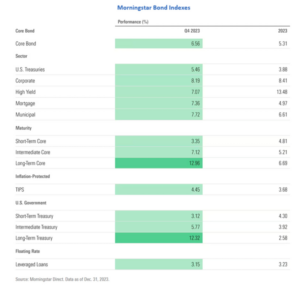

Fixed income rallied +6.6% in the fourth quarter and posted the first positive return (+5.3%) for the asset category in three years. The catalyst during the fourth quarter was declining inflation and the expectation of a Fed pivot in 2024. The strength of the economy has supported positive returns within public credit exposed categories, such as high yield, and has also been a tailwind for private credit, which has benefited from higher short-term rates as well.

International markets also had a positive year in 2023, with the global index ex-U.S. returning 16.2% in dollar terms. U.S. currency depreciation provided a slight incremental tailwind to returns on a local currency basis. Developed markets outperformed emerging markets, with returns of +18.9% and 10.3%, respectively. This outperformance was influenced by China, the largest country component of the emerging market index, which posted a -11% return.

Investment Outlook

2023 saw a strong recovery in financial markets, particularly in the fourth quarter, setting a high bar for the economy, the expected easing by the Federal Reserve, and thematic drivers such as artificial intelligence that helped drive returns in the U.S. technology sector. While the bar is high, the downward trend in inflation, resilient economic growth and employment, and upward revision in earnings expectations provide a basis for optimism. However, the potential for lagging effects of the rise in interest rates over the past 18 months could weigh on economic growth and loan credit. Fundamental headwinds, along with valuation levels above long-term historic levels, merit investment prudence, and a well-diversified portfolio.

For equities, the substantial outperformance by mega-cap growth stocks suggests diversification across size and style is reasonable. If the U.S. avoids a recession and interest rates are cut, smaller-cap stocks appear well-positioned, and value stocks also look attractive relative to history versus growth stocks. International equities also look attractive on a relative value basis versus U.S. equities, and lower rates may result in a further weakening of the dollar, providing a tailwind to returns. For long-term investors, attractive fundamentals, and quality attributes such as earnings consistency, high financial returns, cash flow generation, and reasonable leverage should remain at the core of equity portfolio construction.

For fixed income, the rally in the fourth quarter was historically significant, and a similar level of appreciation would require substantial rate cuts. However, yields remain attractive, with the 10-year Treasury at 3.9% to start the year, and extending duration to lock in yield remains an attractive strategy. Assuming the Fed funds rate is cut during the year, yields on cash accounts such as money markets will likely see meaningful cuts in 2024. Besides locking in higher yields, an allocation to fixed income should see a return to the role as a defensive buffer in the event a recession or other setback were to impact the economy.

In summary, 2023 defied early expectations for financial markets, and significant progress has been made to restore a more stable investment environment after several years of exceptional economic, geopolitical, and policy volatility. While financial markets still face variables in 2024 and beyond, well-diversified investment portfolios grounded in fundamentals and valuation should be positioned to deliver attractive risk-adjusted returns.

Sincerely,

Financial Markets Finish a Strong 2023 Pulling Forward Some of the Positive Catalysts for 2024